are union dues tax deductible in canada

Are Union Dues 100 Tax Deductible In Canada. Whether you are employed or self-employed the Canada Revenue Agency CRA allows you to deduct certain union fees on your tax return.

Safety Tracking Spreadsheet Business Worksheet Spreadsheet Business Business Tax Deductions

You should tell your employee that they cannot deduct from their employment income any non-taxable professional dues that you have paid or reimbursed to them.

. Are Union Dues 100 Tax Deductible In Canada. Union dues are based on the 1st step salary of your classification as found in your collective agreement. To deduct membership dues dues only to unions.

Current PSAC deductions cease in pay system. Please note that at this time you will need to refer to your older. Line 21200 was line 212 before tax year 2019.

If the CRA asks for proof of which union your dues were paid to contact the payroll department of your employer and request a brief letter stating that they remitted the dues to MoveUP in 2013. Learn about various aspects of labour relations and human resource management. You can deduct union dues as a business expense even if youre a self-employed person.

You may claim a tax deduction on line 21200 of your tax return and if your employer is a GSTHST registrant you may be able to claim a refund for a portion of your union dues. Get information on grievances union dues exclusions strike and crisis. Union dues are set by the bargaining agents and calculated either by using a fixed rate or as a percentage of the employees salary.

You can deduct any union dues paid by you from your taxable income. What does the employer do with the union. In other words union membership fees licenses and charges cannot be.

Membership Dues for Trade Unions Only membership dues for a trade union are deductible other charge deductions are. Taxation of Union Dues. Learn about claiming your annual professional or union dues on your income tax return to lower your taxable income and reduce your tax burden.

New rules for union dues elections will allow people who pay union dues assessments or initiation fees these people are called dues payers to opt-in to pay the. Calculate amount of arrears owing to. You can claim these amounts for a tax.

The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44. The general rule for claiming such a deduction is described in the annual income tax return guide as follows. For example if your annual income is 40000 and you paid 1000 as union dues your taxable.

Create a plan that maximizes the value of your membership. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your. Are Union Dues 100 Tax Deductible In Canada.

Its important that you do not claim your tax deduction for union dues. For more information see. The amount of union fees you can claim is listed in box 44 of your T4 tickets or receipts and includes any GST HST you have paid.

Current PIPSC deductions commence in pay system. A unions fees are 100 deductible at tax time allowing members to deduct their contributions instead of paying. Members of trade unions are eligible to deduct membership dues as long as they do not deduct fees licenses or other costs.

While a majority of employees can continue to deduct union dues on their federal tax. Union dues and excluded positions. Handling Union Fees.

Line 212 Claim the total of the following amounts related to your employment.

Claiming Union Dues And Other Professional Fees

How To Claim Union Dues On The Tax Return Filing Taxes

2020 Year End Tax Tips For Canadians Cloudtax Simple Tax Application

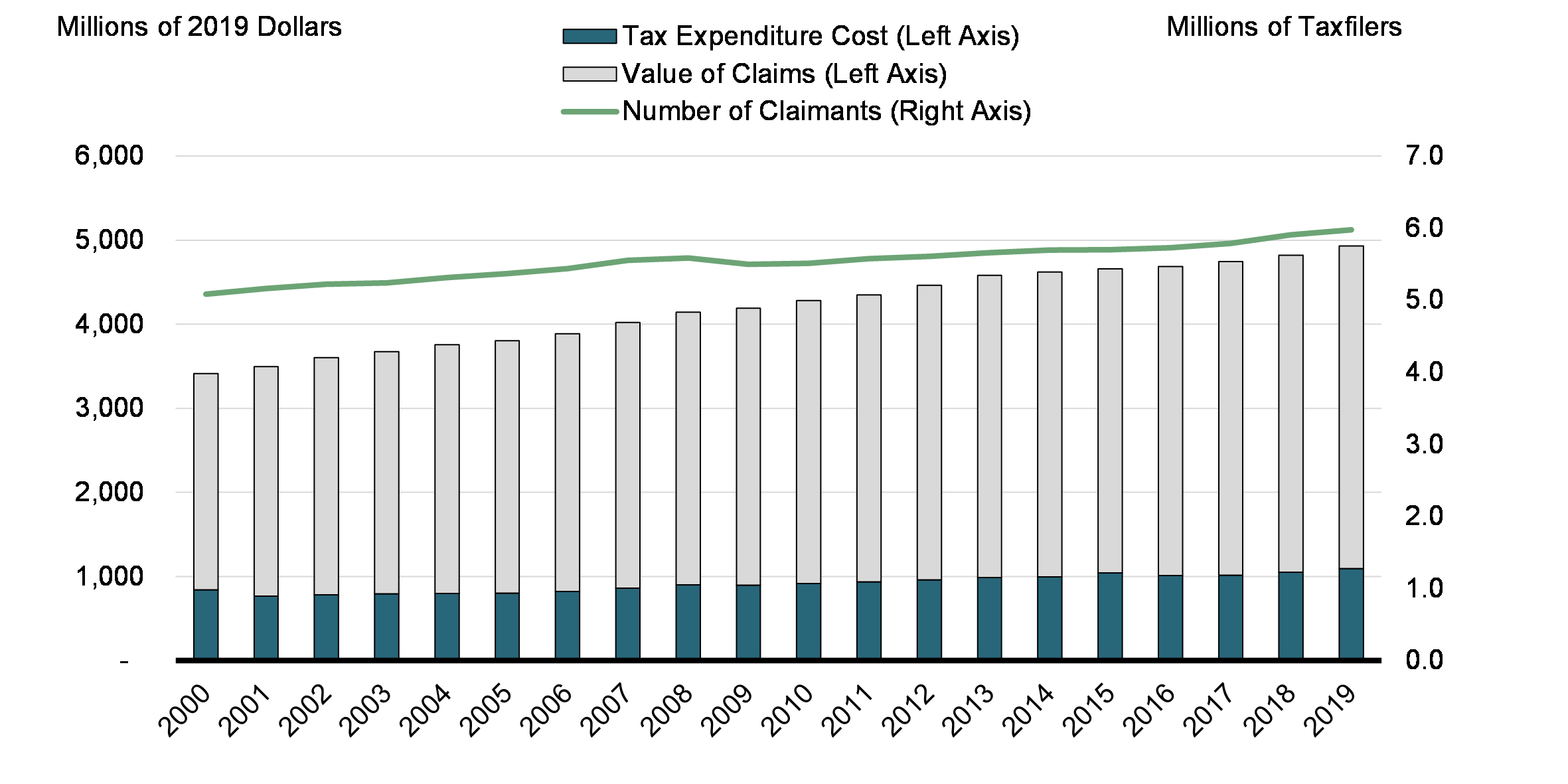

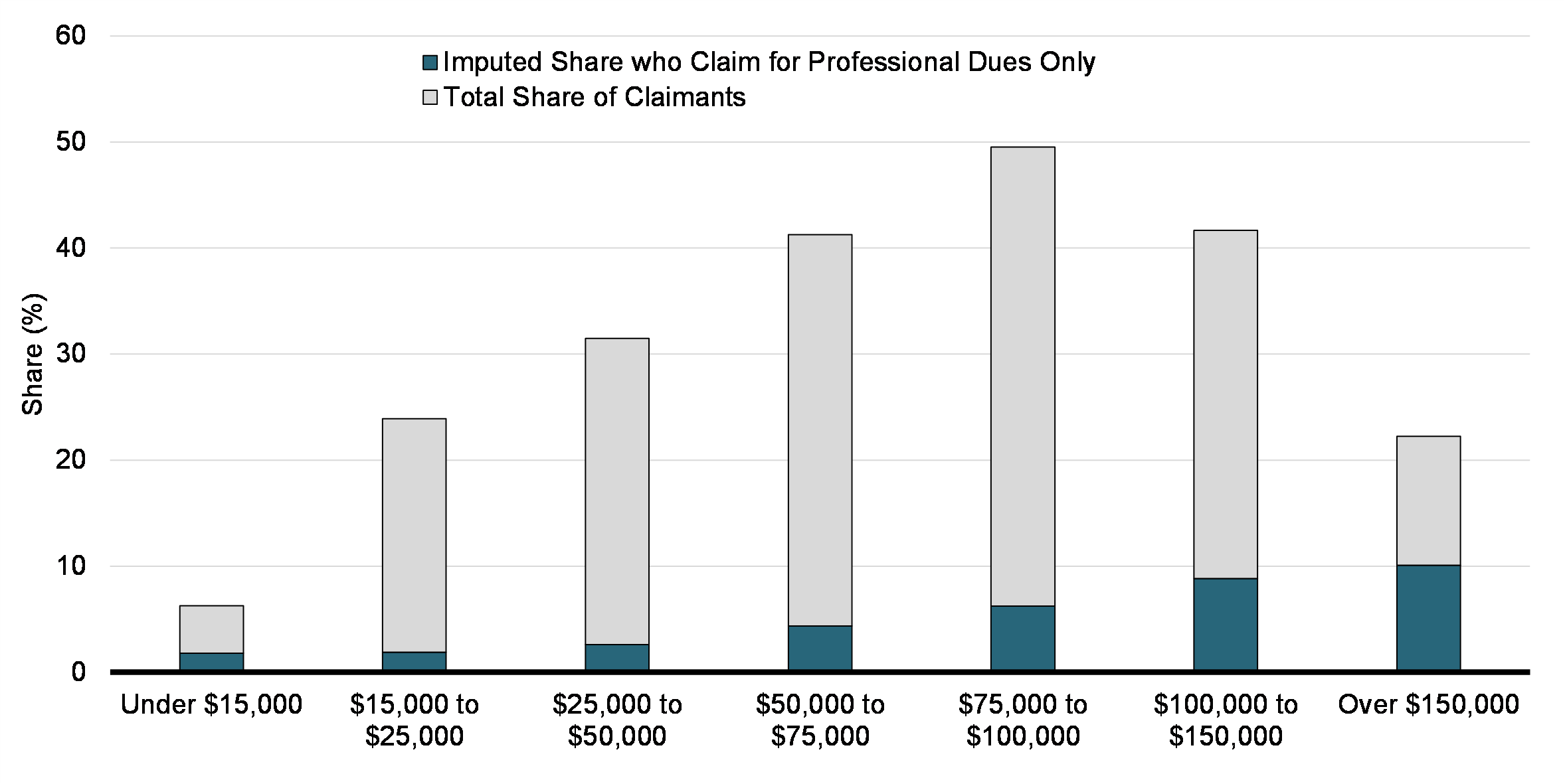

Report On Federal Tax Expenditures Concepts Estimates And Evaluations 2022 Part 9 Canada Ca

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

It S Time To Get A Payback Make Your Deductions Less Save Your Taxes More Legally With Skans Accountants Call 416 741 Moving Expenses Deduction Accounting

The Top 9 Tax Deductions For Individuals In Canada

Where Do I Enter My Union And Professional Dues H R Block Canada

Where Do I Enter My Union And Professional Dues

Spring Cleaning 20 Hidden Tax Deductions You Ll Be Glad You Found 2022 Turbotax Canada Tips

Where Do I Enter My Union And Professional Dues

What Are Payroll Deductions Article

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

Tax Receipts For Union Dues For 2021 Local Union 488

Different Types Of Payroll Deductions Gusto

Report On Federal Tax Expenditures Concepts Estimates And Evaluations 2022 Part 9 Canada Ca